Need help? Save yourself a call.

Get instant answers and info for the most common questions we get.

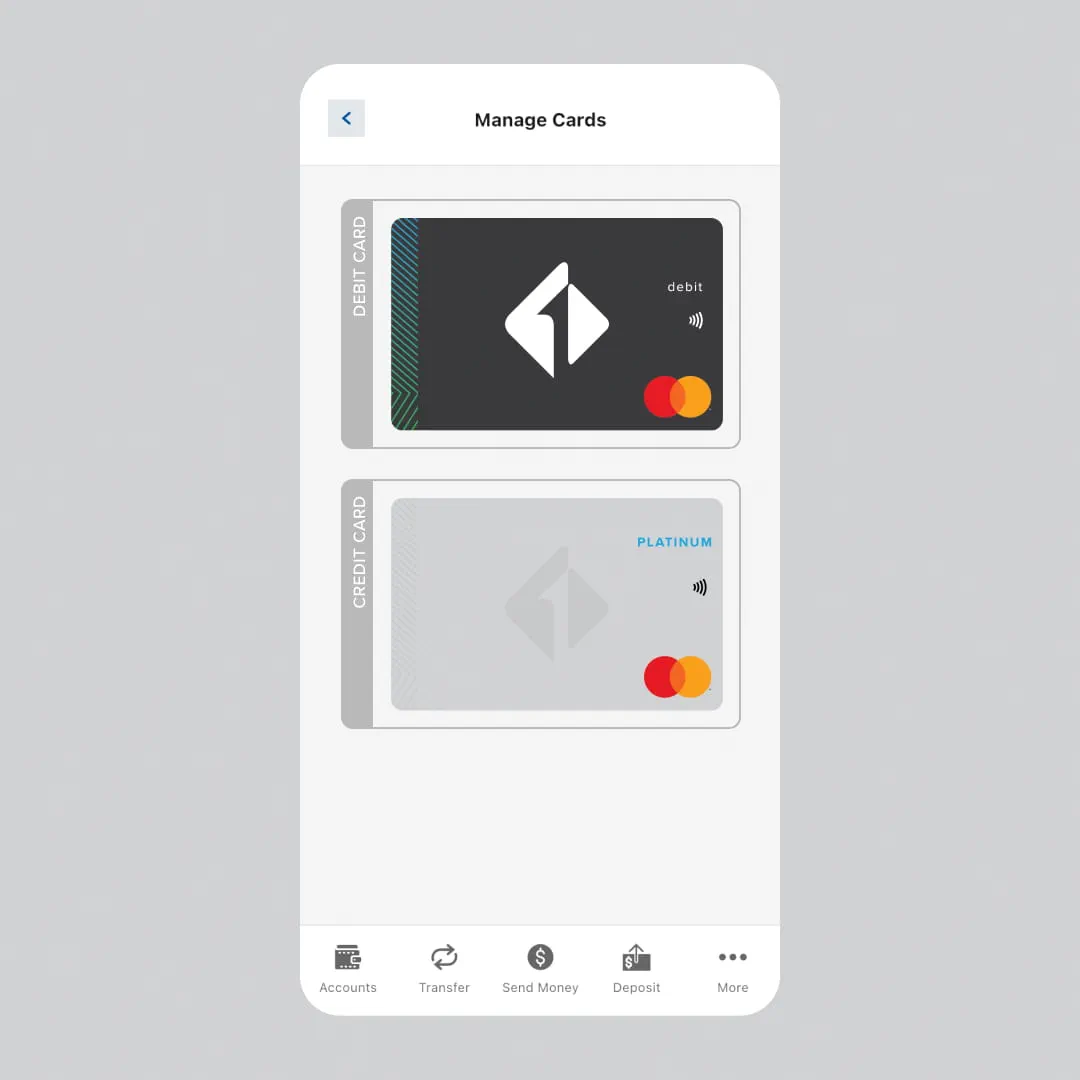

Report your card lost or stolen, change your PIN, file disputes, and more all in one place.

Choose the best option for your transfer.

| Zelle® | Wire Transfer | Electronic Funds Transfer (EFT)/Automated Clearing House (ACH) Transfer | |

| Speed | Minutes | Same day | 3-5 business days |

| Daily Limit | Varies Log in to see your daily limit. |

Based on available balance | $25,000 |

| Fees | None | Incoming: $0 Outgoing domestic: $15.00 Outgoing international: $40.00 |

None ($15.00 return ACH origination fee on unsuccessful transfers) |

| Best For | Friends and family | Large, urgent or international transfers | Regular transfers and payments |

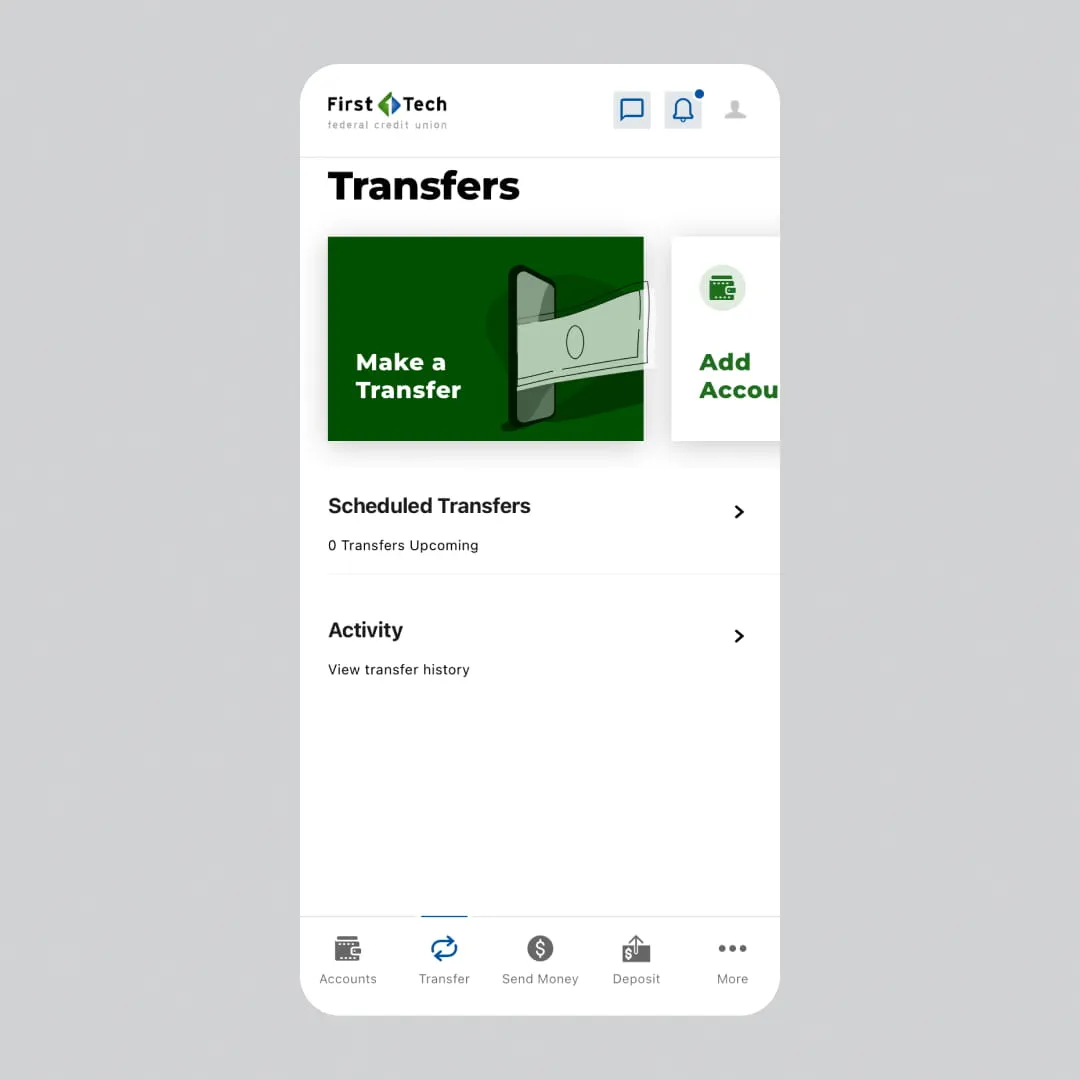

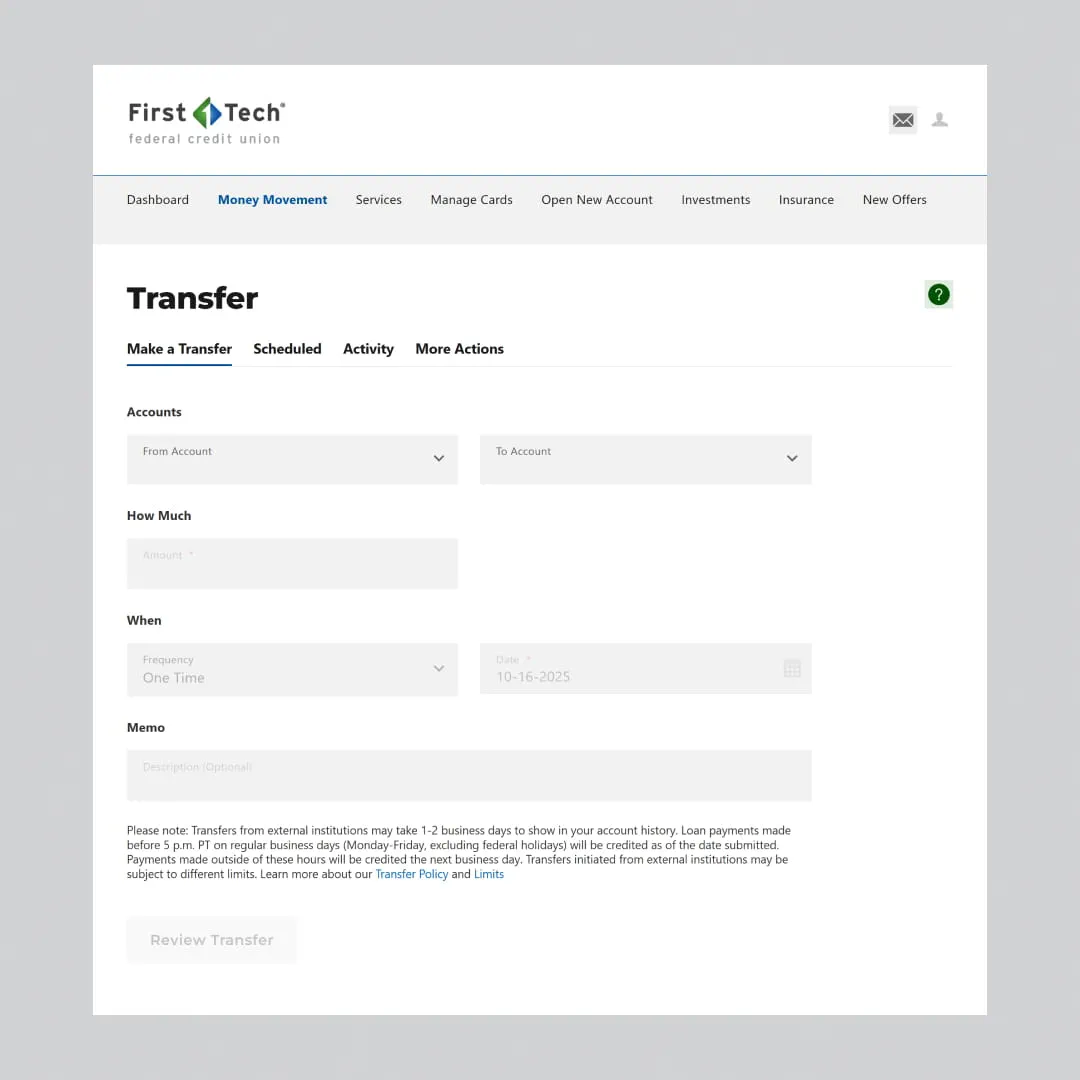

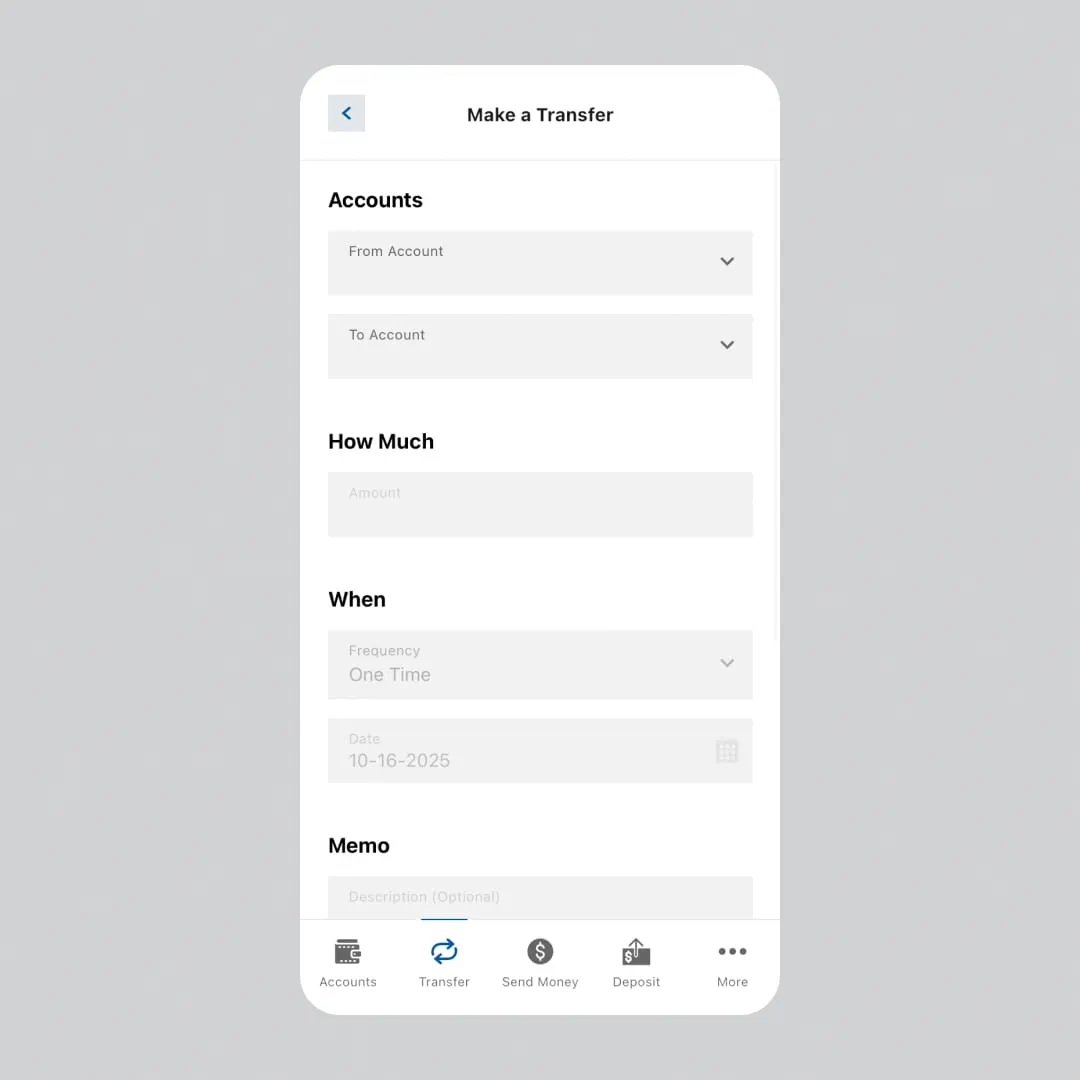

Use Digital Banking to easily transfer money between your First Tech savings and checking accounts or to make a payment to a First Tech loan or credit card.

- Log in to Digital Banking on desktop or mobile.

- Go to Money Movement > Transfer.

- Select the appropriate accounts in the From Account and To Account drop down menus.

- Enter the amount, frequency, date and optional memo information and click the Review Transfer button.

- Review the transfer information for accuracy and click Submit Transfer to send.

For additional instructions, view this How-To.

Adding an external account allows you to quickly and securely transfer money between financial institutions and make payments via ACH transfers. There are two parts to the account linking process:

- Enter the financial institution’s routing number and your account number into Digital Banking.

- Confirm the microdeposit amounts we sent to test the link between the two accounts.

Detailed step-by-step instructions for linking your external accounts to First Tech:

Mobile Banking (First Tech app)

You can easily send a wire transfer to another bank with Digital Banking on your PC, Mac or through a browser on your mobile device. Note you cannot currently send a wire transfer with the First Tech mobile banking app.

- Log in on desktop and select Wires from Money Movement dropdown at top of page.

- Enter the required information in the form fields.

You will need the following information about the Beneficiary and their financial institution that will receive the funds:

- ABA Routing/Transit Number (for banks in US)

- SWIFT BIC Number (for foreign banks)

- Name of the financial institution

- Name, home address and account number of beneficiary

Watch this video for step-by-step instructions.

To receive a wire transfer in your First Tech checking or savings account, you will need to give the sender this information:

Domestic wire transfer (sender with US bank account)

| Federal Reserve Bank ABA Number | 321180379 |

| Receiving Bank Address | First Tech Federal Credit Union |

| Receiving Bank Address | 5100 NE Dawson Creek Drive, Hillsboro, OR 97124 |

| Savings or Checking Account Number | Your account number |

| Recipient Name | Your name as it appears on your First Tech account |

| Recipient Home Address | Your home address |

Additional incoming domestic wire information

International Wire Transfer (sender with foreign bank account)

| Receiving Bank | First Technology Federal Credit Union |

| Receiving Bank Address | 5100 NE Dawson Creek Drive Hillsboro OR 97124 |

| Receiving Bank SWIFT | FTFCUS66 |

| Recipient Account Number | Your account number |

| Recipient Name | Your name (as it appears on your First Tech account) |

| Recipient Address | Your home address |

Intermediary Bank: The intermediary bank used for U.S. correspondent banking and exchange can be chosen at the sending institution’s discretion. If the originating institution does not have a U.S. correspondent, the sender may opt to use PNC Bank (PNCCUS33). It is very important that, if an intermediary or correspondent bank is used, the wire instructions explicitly state that First Tech is the beneficiary bank.

Additional incoming International wire information

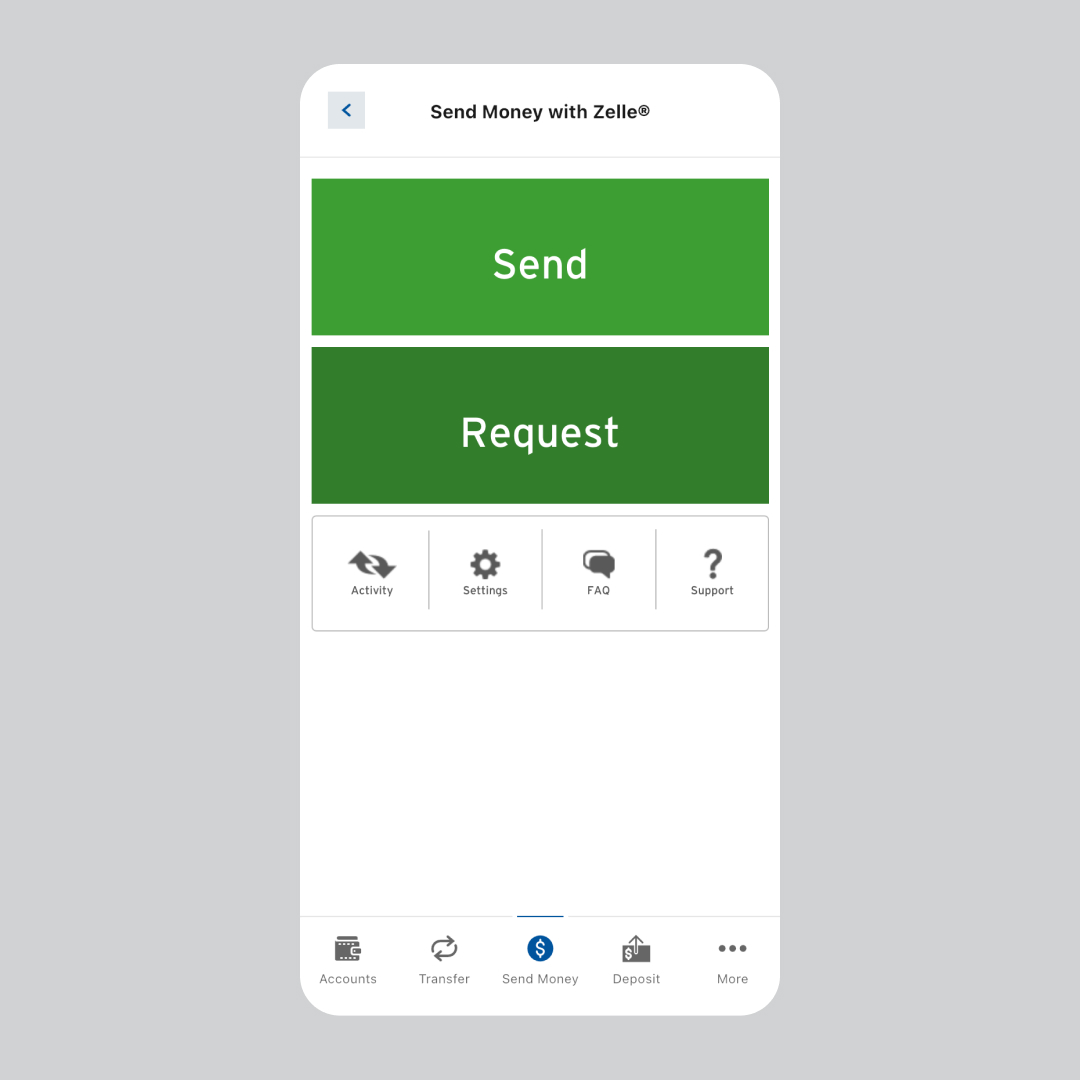

Simply enroll in Zelle® to start sending or receiving money.

- Log in to Online Banking and go to the Money Movement tab.

- Read and accept the Zelle® Terms & Conditions.

- To receive money, enter either your U.S. mobile number or email address you'd like to link.

- Select the First Tech account you'd like to use to send or receive money.

To send money, select a contact (mobile number or email), enter the amount, and confirm. The recipient will automatically receive an alert about receiving your payment.

To receive money, share the mobile number or email address you used to enroll in Zelle® with the sender. Incoming funds typically arrive in your linked First Tech account within minutes.

For step-by-step instructions, view this How-To.

First Tech has daily limits on Zelle® transfers to keep your account secure. Limits vary by transaction and recipient. Your applicable limits are shown in Online Banking or the Mobile App when you set up a Zelle® payment.

If you’ve already sent money, you’ll see your remaining Zelle® limit for the day.

Absolutely. Zelle® works across hundreds of banks and credit unions nationwide. You can send money to anyone enrolled with Zelle® at a U.S. financial institution.

Just make sure you have the correct U.S. mobile number or email address linked to their Zelle® account.

You can enroll with Zelle® using your mobile number, your email address, or both. Each can only be linked to one financial institution at a time. Be sure to give the right one to people who will send you money.

To update your enrolled mobile number or email:

- Log in to Digital Banking or the Mobile App

- Go to Money Movement > Send Money with Zelle® > Settings > Manage Payment Profiles

- Select or update the mobile number or email that you want to update and follow the prompts to change and verify it

You can only cancel a Zelle® payment that you attempted to send to mobile number or email address that is not enrolled in Zelle®. If the Zelle® payment is sent to an enrolled mobile number or email address, the money will be automatically deposited into the recipient’s account and cannot be canceled or reversed.

To check, go to your activity page, select the payment, and choose Cancel This Payment.

Only send money only to people you know and trust and always verify that you’re using their correct mobile number or email.

If you received a Zelle® payment notification but don’t see the funds, the payment may have been sent to a mobile number or email that isn’t currently enrolled with Zelle.

Make sure the sender is using same mobile number or email you’ve enrolled with Zelle. You can check and update your Zelle contact info in Online Banking or the Mobile App.

- Log in to Digital Banking or the Mobile App

- Go to Money Movement > Send Money with Zelle® > Settings > Manage Payment Profiles

- Select or update the mobile number or email that matches how the funds were sent to you

Once your info matches what the sender used, the payment should be deposited into your account.

If you believe you’ve been scammed or sent money to someone under false pretenses, take the following steps right away:

- Review your account activity and note any suspicious transactions or payments.

- Contact First Tech support immediately to report the transaction.