Promotional CertificatesEligible only for funds not currently or previously held in a First Tech Federal Credit Union account at the time of this offer. Funds must be deposited from a source outside First Tech; transfers between First Tech accounts or its affiliates will not qualify for this promotional rate.

Move money to First Tech and lock in a great rate that protects against market volatility. With share certificates, you can earn top-tier returns without taking on unnecessary risk. These low-risk investments from First Tech are easy to open and renew. As a bonus, there are no account setup or maintenance fees.

Bump Up Certificates

Traditional Certificates

Types of Share Certificates: Find Your MatchMembership is required and subject to approval.

At First Tech, you can choose from a wide variety of certificates to find a term that fits your investment goals. You can also use a share certificate ladder to spread your investment across multiple certificates with different terms.

Traditional 6 and 60-Month Share Certificates

At First Tech, you can choose from a wide variety of certificates to find a term that fits your investment goals. You can also use a share certificate ladder to spread your investment across multiple certificates with different terms.

Traditional certificates terms range from 6 and 60-month, providing flexibility for you and your investment goals.

This option could be a great choice if you:

- Want a high-yield account with low-risk

- Have at least $500 to invest

- Prefer a hands-off approach to savings

Bump-Up Share Certificates

If you want the security of a certificate but think interest rates might rise, First Tech’s bump-up certificates could be your ideal investment match. Our bump-up certificates are available in terms ranging from 13 to 36 months. Should rates rise before your certificate matures, you’ll be rewarded with a higher interest rate for the duration of your term.

Bump up certificates are a great choice for:

- Flexible Rate and Balance options: Enjoy the ability to increase your rate or balance during the term, giving you more control over your investment.

- Low-Risk Investment: A safer alternative to the stock market, providing peace of mind while growing your savings

- Hands-Off Savings: Perfect for those who prefer a straightforward approach to savings to money.

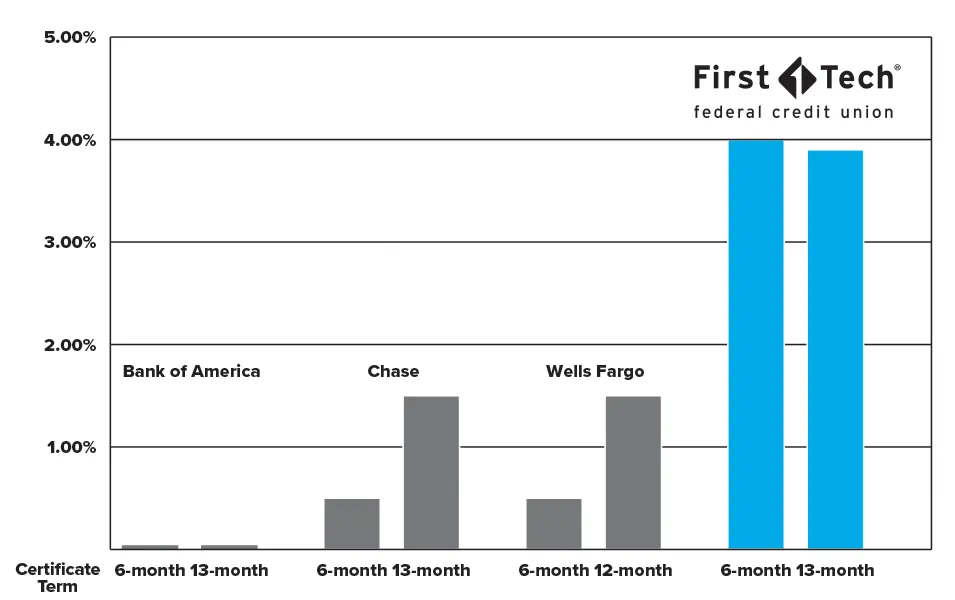

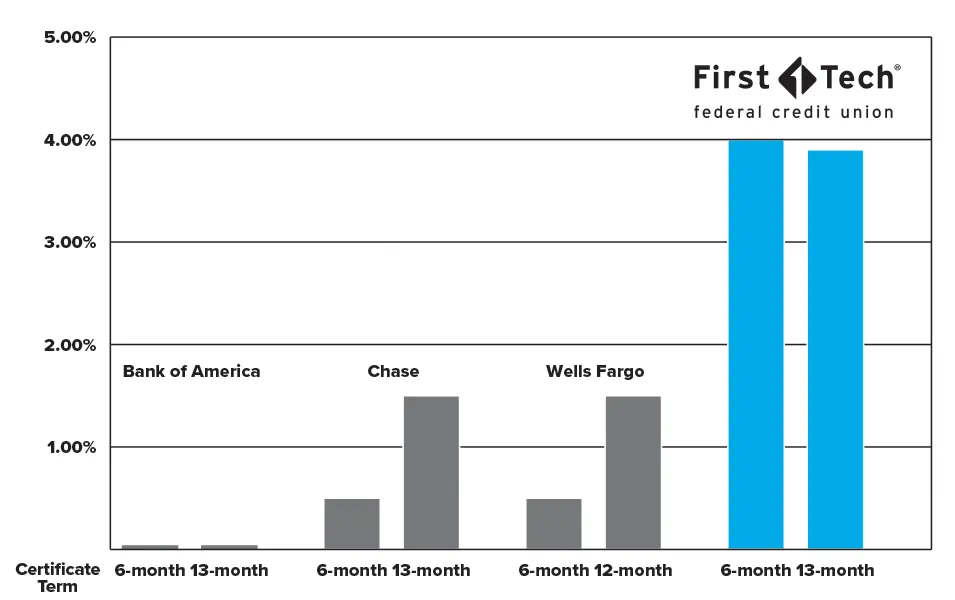

Don’t settle for below average rates.

Our certificates deliver highly competitive APYs, giving you higher rates when compared to banks and other credit unions.

CERTIFICATE APY COMPARISON CHARTRates as of 2/2/2026 as published on bank websites, including Bank of America Fixed-Term Certificate of Deposit (CD), Chase CD, Wells Fargo Standard Fixed Rate CD

Benefits of a certificate from First Tech

Fixed APY for the term of your certificate

Open with as little as $500 with no deposit limits

No account set-up fees or maintenance fees

Secure Savings that are federally insured with the NCUA up to $250,000

Bump up certificates allow you to add funds once per term to grow your balance

10-day rate guaranteeRate Guarantee: Starting on your account opening date or maturity date and extending for 10 calendar days, if your Share Certificate Account reaches the minimum deposit threshold, you will receive the highest published dividend rate and APY we offer for the term and balance tier of your account during that period. : Ensures your rate won’t drop while you add funds